Professional Market Research...Superior Market Reports

Tel & Fax: 08456 524 324 (local rate)

Press Releases & News

Kitchen Furniture Market 2010-2014

Take a Fresh Look...

|

Kitchen Furniture Market

Research & Analysis Report - UK 2010

|

||||||||||||||||||||||||||

|

Click Here for... |

Click Here to View.. |

Click Here for... |

Click Here to Download... |

Click Here for... |

Click Here to Download... |

|||||||||||||||||||||

|

Information on the Market Report & Mailing List for the UK Kitchen Furniture Market 2010 |

||||||||||||||||||||||||||

|

MTW Research have published a 350+ page, brand new Research & Analysis market report on the UK Kitchen Furniture Market, providing a comprehensive & detailed review of the UK fitted and freestanding kitchen furniture market, kitchen sinks market, kitchen worktops market, bar tables and stools market and kitchen tables market.

This brand new market report on the UK Domestic Kitchen Furniture Market provides a fresh, comprehensive & reliable review of this market in 2010 and future prospects to 2014. This new style report combines the best of both with in depth qualitative comment and trend analysis coupled with detailed and more accurate quantitative data, based on sales figures directly from the kitchen furniture market.

Written specifically for kitchen furniture manufacturers, suppliers and kitchen retailers, the report is available immediately in a range of digital or hard copy formats for ease of dissemination with your colleagues and provides sound market intelligence for use in presentations and management reports at all levels.

Based on sales data from a representative proportion of the kitchen furniture industry, this report provides market size, product share and distribution channel mix by value over a ten-year period. With more than 350 pages of quantitative data and qualitative input from the industry, our reports are more accurate than other qualitative based reports and offer better value for money. Written by experienced marketing professionals who have been writing market reports on this industry for more than 10 years, this report provides quality market intelligence by identifying and discussing key market and product trends, product mix, channel shares, opportunities, threats, influences, SWOT & PEST analysis in a complete yet easy to read and digest format.

This 350+ Page Report Includes:-

Market Size 2004-2014, Product Mix & Key Design / Style Trends Provided for:-

Quantitative market data based on industry sales, supported by qualitative discussion of key market trends, product trends and mix, influences and future prospects are provided. Wholly updated & revised in February 2010, this informative & stylish report offers a comprehensive review of the kitchen furniture market, provides key kitchen retailer sales leads and also represents excellent value for money.

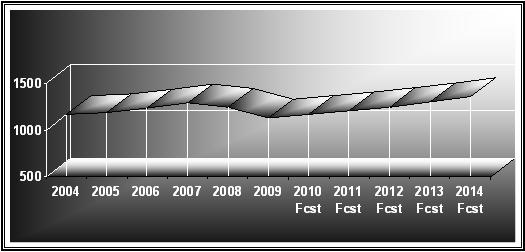

UK Kitchen Furniture Market 2004-2014 £M

Source: "Kitchen Furniture Market Research & Analysis Report - UK 2010-2014"

The UK kitchen furniture market is currently valued at £1.16 billion in 2010 at manufacturers selling prices, reflecting a market which is now entering a tentative growth phase following difficult trading conditions during the last 2 years. Sources indicate that the market peaked in terms of value during the first quarter of 2008 with the economic downturn being more profoundly felt by the industry during the second half of the year. The economic slowdown which took hold in Q2 2008 and subsequent negative impact on consumer confidence, housebuilding and house moving levels resulted in a rapid contraction in volume terms for the kitchen furniture market, with the market value declining rapidly in 2008, despite a relatively positive start to the year.

Consumer expenditure on big ticket items continued to decline in H1 2009, with the kitchen furniture market being particularly affected as householders sought to defer larger purchases. The rapid slowdown in the housing market also impacted the sector, with house moving levels often closely linked to purchases of new kitchen furniture. The slowdown continued through the third quarter of 2009, though trade sources indicate that slowly improving economic conditions in Q4 2009 prompted some optimism in the market, with, if not an improvement in market value then a cessation of decline evident. Slightly improved trading conditions during Q4 2009 resulted in the year closing substantially down on the 2008 market value. This decline may well have been more severe if not for a return to growth in the housing market and slowly improving economy in the latter stages of the year, with UK recovering from recession and GDP rising, albeit by a very modest 0.1% in the last 3 months of 2009.

As highlighted in the above chart, the impact of the economic downturn on the kitchen furniture market has been severe. Our estimates are that the recession has potentially cost the industry in the region of £250 million of lost sales and growth relating to this sector specifically, reflecting a cost of around £10 million per month to the industry since the beginning of the recession in 2008. The level of business failures in both the manufacturing and distribution sectors of the kitchen furniture have continued to rise in recent months, with the effects of the economic downturn likely to reverberate throughout the industry for several years, more than 10% of kitchen retailers are currently considered 'at risk' by MTW.

Near term prospects for the industry are more positive, with a relatively steady rise in market value forecast for 2010 by value. In terms of macro-economic issues, the economy should continue a track of slow recovery during the first half of the year, followed by a more positive upturn in H2 2010. This, coupled with an improvement in the housing market and rising levels of consumer confidence should underpin some return to growth for the kitchen furniture market in the near term. An accelerated pattern of growth is forecast for the industry from mid 2010 onwards, reflecting an anticipated growth rate of around 16% between 2010 and 2013. Whilst inflation growth will negate some of this growth in the near term, our forecasts are for the industry to grow in real terms from Q3 2010 onwards. Key Features Of This 350+ Page Report Include:-

KITCHEN FURNITURE MARKET SIZE 2004-2014

MARKET TRENDS & INFLUENCES Quantitative & Qualitative Key Market Trends 2004-2013, including

PRODUCT TRENDS & MANUFACTURERS REVIEW Product Mix & Key Trends in Each Sector 2004-2013, including

DISTRIBUTION CHANNEL SHARE & KEY TRENDS Share, Trends & Structure of Distribution Channels, including

SUPPLIED AS PART OF THE ‘ULTIMATE PACK’

Ultimate Pack Includes:-

Key Benefits Of This Brand New Report Include:-

In Order to Provide a Comprehensive Review of the Market, This Report Includes:- THE MARKET, PRODUCTS & END USERS

THE SUPPLIERS & INDUSTRY STRUCTURE

Prices for the Kitchen Furniture Market Research & Analysis report are as follows:-

To order this report from MTW Research, please complete the order form here

|

||||||||||||||||||||||||||

|

Click Here for... |

Click Here to View.. |

Click Here for... |

Click Here to Download... |

Click Here for... |

Click Here to Download... |

|||||||||||||||||||||